The Oil Industry 2020 – Winners, Losers And Everything In Between

Athletic endeavors, especially team sports, can be rewarding to participate in or watch at any age. Developing teams and players includes conditioning, diet, mental training, and finding the right “mix” of players to form the winning team. Soccer, Baseball, Rugby, or Basketball teams play an array of opponents. Very few teams in history complete a season undefeated. Even those undefeated teams over time can go from the top to the bottom of the ranking with a shift in coaches or team members. Often, those teams that faced and learned from adversity were better prepared to excel late in the season or between seasons.

In a similar way, the energy industry is a collection of “teams” both internally and in competition externally in the market. The COVID-19 pandemic event has changed the oil industry, potentially forever.

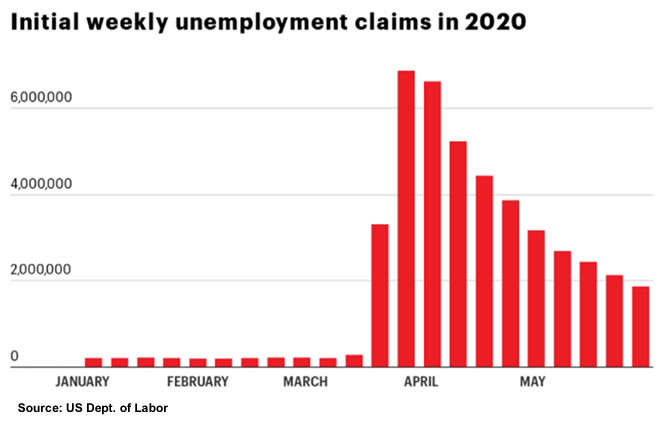

A glimpse of “peak” oil demand from the COVID-19 lockdown resulted in US gasoline demand being the lowest in 50 years. The Q1 2020 fuels demand reduction resulted from a substantial economic downturn, with 14.7% US unemployment for April 2020 (Statista). The employment rate has improved to 13.3% for May, partly from opening up of the states and partly from the stimulus checks being spent.

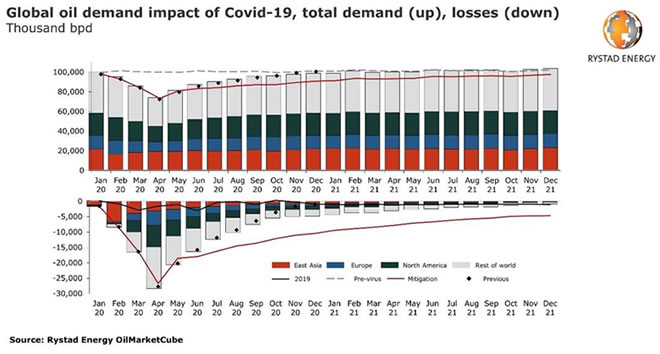

Recent OPEC+ meetings extended the 9.7 million barrels per day production cuts through July 2020. Bankruptcy filings in the shale oil and mid-stream sector will continue to impact the North American markets in several ways. Announcements of oil industry job losses from BP, Shell, Chevron along with reduced shale production will add to the secondary markets employment losses, thereby pushing economic recovery further forward. Rystad Energy highlights shifts in projections given the actual relaxing of lockdown. The “V” shape is more protracted indicating recover well into 2021.

Kuwait and Aramco are substantially reducing expatriate labor forces in their countries and energy organizations to combat profit losses. Crude prices below $50/bbl have reduced oil reserve valuations substantially and continue to impact capital spending from the oil majors, with typical reductions of 20 to 30%, thereby taking multiple billions of dollars out of projects and investment spending. Aramco alone has cut up to $30 Billion in capital spending.

To help the energy industry, especially refiners and petrochemical companies, address these challenges, Becht provides strategic analysis services with focus on these key elements:

- “Leave no stone unturned”

- Now is the time to revisit Strategic Business Planning – especially as it relates to the risk impacts on economic and technical viability under volatile market shifts

- Cold eyes gap analysis of existing plant assets to identify and implement improvement opportunities to maximize value of people and systems

- Review the accuracy of analysis tools, such as Linear Programs (LPs) to ensure financial and strategic decisions are based on the right input

- Stress test the short-term and longer-term plans

- Review an array of scenarios on pricing testing cracked spreads

- Review demand for each commodity looking beyond regional to global markets

Becht has the subject matter experts, methodologies, and tools to support the energy industry in addressing these challenges. In the next series of this blog, Becht will focus on staff skill development as part of COVID-19 recovery. View Part 2

Have a question about this blog or wish to contact Becht for assistance?