First Principles of Energy Transition – An Unbiased Look at the Data and Principles: Part 1

This is the first part of a two part article,

as published in Decarbonisation Technology, August 2021

Contributing authors: Jean-Gaël Le Floc’h, Mel Larson and Darren York

Energy Transition – What does it really mean?

In the current lexicon of society, terms, and concepts such as decarbonization, greenhouse gas emissions reductions, carbon neutrality, and energy transition are becoming commonplace, not only within the energy industry but also with the common consumer. Events like the COVID-19 pandemic, shifts in virtual work and travel, and changes in regulatory requirements and economic incentives have dramatically accelerated shifts in the energy industry to produce cleaner and lower carbon intensity fuels and products. However, does the average consumer understand the extent of fossil derived energy sources and products and the implications of these shifts and mandates away from fossil fuels on their daily lives and access to affordable fuels, products, and energy? How will Refiners and Petrochemical organizations respond to these changes in a dynamic marketplace that demands both profitability and environmental stewardship? Can the Energy Industry and front-line consumers achieve carbon neutrality by the target dates and what changes are required to meet those targets?

To begin to answer these questions, we must first look at some of the fundamentals that are influencing these market changes and mandates. Our intent is not to pick “winners and losers” or question the reality of climate change, but to examine various examples from a first principles perspective. Doing so will help provide focus and clarity on the challenges the Energy Industry (i.e. Utilities, Transportation Fuel Providers, and Petrochemical Firms) faces and will allow both the consumer and producer to rationalize the choices and technical challenges that must be addressed to meet these targets. This two-part series will first focus on various examples in hydrogen, batteries, metals, and electrical infrastructure to help illuminate the real impacts of energy transition and decarbonization. The second part of the series will provide additional examples within hydrogen and energy optimization as well as outlining several considerations and options for the Energy Industry to apply in order to address this transition.

The Sheer Magnitude of the Change

The current goal of the Paris Accord is to limit the rise in global temperatures to 2°C by 2050. While the goal seems reasonable enough, there are competing forces that put serious pressure on achieving the goal. First, global energy use is strongly driven by total population and GDP (Gross Domestic Product) growth. Global population is projected to grow from about 7.8 billion people in 2020 to over 9.7 billion by 2050, which represents a ~25% growth over that period, and the bulk of that growth will occur in emerging markets, while at the same time postmodern regions will be flat or declining in population. Over that same time period, total annual energy demand is expected to grow from ~ 635 quadrillion BTU to over 900 quadrillion BTU by 2050, which represents more than a 40% increase over that period. Yet, to meet the GHG reduction targets, the total energy per GDP (i.e. energy intensity) must decrease by around 35% on a global basis. In simple terms, to continue to drive GDP growth for an ever-growing population, we need energy to do so but now have to do “more with less”. In addition, the percentage of that energy pool that is petroleum and coal based must decrease by over 25%, as a minimum.

Hence, the energy we need to drive our economies, heat and cool our homes and businesses, cook our meals, and transport our people and goods must now largely come from renewable sources – wind, nuclear, solar, renewable hydrogen, and renewable electricity. Significant, technically sound, and market driven diversification of our energy sources and providers, along with behavior change by consumers and streamlined governmental mandates and incentives, is needed to meet this challenge. No “silver bullet” exists to achieve this goal – it requires an “all of the above” strategy.

Mitigating Unintended Consequences

Moving to “green” renewable based energy sources has to consider the whole system, including the cycle of “harvesting”, production, processing, and use. For instance, what is to be done with the increased waste from wind turbines, lithium batteries, and PV solar panels, as most of these elements are not currently recyclable and have a 10 to 20 year useful life? What is the consequence to the environment from harvesting raw materials and then landfarming waste, given that recycling technologies are presently more carbon intensive than first generation production?

Using bio sources for fuel such as Soybean oil, Palm Oil, Rapeseed (canola), Ethanol (sugar cane or sugar beets), or other bio sourced components pits land use for food to feed the world’s growing population against a more lucrative value of fuel sources. Does it make sense to deforest land to plant seeds for fuel? While use of used cooking oils (UCO) as a source for renewable fuels fits well with the recycling mantra, application of virgin oils for renewable production will strain the tension between food versus fuel. One of the less discussed aspects of “green” is the water consumption necessary for both mineral harvesting and bio source production. Water is a scare resource and, in many regions of the world, arid conditions require severe water conservation. Hence, the conversation on water use, reuse, and stewardship must be on a similar level as the shift in energy sources.

Metals and Battery Balances

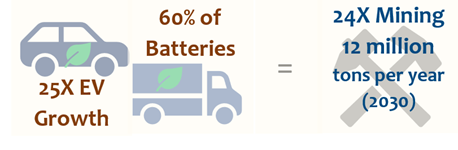

While EV adoption rates remain low in the US and in Japan, with Japan’s marginal power production coming from coal-powered plants with high CO2-eq emissions, the EV share in new car sales has shown an increasing trend in many other developed countries in Europe as well as China. This trend will continue to spread (x25 EV car sales in 2040 compared to 2020) and it is anticipated that the total battery demand annual growth rate will be around 38% (CAGR), or a x25 factor in 10 years’ time. Within the battery sector, over 40% of batteries will be dedicated to stationary energy storage, while 60% will be used for passenger and commercial vehicles as well as ships. Most battery raw material tonnage demand will follow the battery trend, around 40% increase per year, from a total of about 0.5 million tons in 2020 (Cobalt + Silicone + Lithium + Nickel + Manganese + Graphite) to 12 million tons in 2030. Taking Lithium as an example, its extraction requires large amounts of water, and results in up to 15 tons of CO2 emission per ton of Lithium for hard rock mining.

One of the main anticipated future constraints and risks is the high concentration in terms of players, not only in the mining industry, but also in the processing/refining industry. The main metals under consideration are Lithium, Nickel, Cobalt, Manganese and Graphite (batteries), and the situation is very similar for rare earth elements (wind turbines and electric vehicle motors), as well as for Copper, Silicon, Silver (solar PV), and Aluminum (electricity networks). Supply chain assurance will be required in order to mitigate risks of disruption for various reasons such as political instability or trade restrictions.

Battery recycling will help mitigate the risk of supply disruption, but it is anticipated that the recycling of spent Lithium-ion batteries will only account for about 8% of the demand. Current recycling technologies are energy intensive, partly due to the fact that batteries are not designed with future end-of-life recycling in mind. Advances in battery recycling are critical to ensure that we are not simply trading extraction of oil for extraction of metals. Other mitigation measures should include a diversification of the supply partners, with an increased collaboration of all the supply chain stakeholders, supported by a higher transparency, and a consistent set of social and environmental standards.

Expansion in Electrical Infrastructure

Electricity networks are a key element of reliable power systems, and will play a decisive role in the growth of renewable power adoption. Most power line’s length (90%) is made up of the distribution systems, serving to deliver power to the end users. The transmission systems, connecting the heavy power production centers (power plants, solar and wind power production facilities) to the load centers, make up the remaining 10%.

The electrification wave coming from the energy transition will require building new lines, as well as refurbishing the existing ones, for increased resilience to more extreme weather events. The anticipated increase in terms of power lines due to energy transition is estimated to increase by a factor of 5 between 2020 and 2050.

The traditional metals used in power cables are Copper and Aluminum. Copper’s electrical conductivity as well as thermal conductivity are both about 60% higher than Aluminum’s. However, Copper is three times heavier than Aluminum, and about three to four times more expensive on a weight basis. Copper is typically used for subsea and underground lines, while Aluminum is preferred for overhead lines due to its lighter weight. From a cost perspective, Aluminum is being considered for underground lines as well, as regulation permits.

Another mitigation measure to reduce the impact of increased electrification would be a scale up in use of High Voltage Direct Current (HVDC) to complement the traditional Alternating Current (HVAC) systems currently in place. HVDC only requires two cables vs. three with HVAC, which would reduce the need for mining and metals. Therefore, HVDC cables are usually cheaper than HVAC and have very limited losses. However, the costs and losses of DC converters are significantly higher than AC transformers, and the break-even distance between the two systems still need to be reduced to further promote HVDC.

What is Next?

In part one, we have reviewed how metals, battery, and electrical infrastructure must change substantially in the coming years to meet the shift to an electrical power based economy and reduce fossil fuel usage in order to meet the targets of the Paris Accord. This shift in energy sources must also occur during a period of continued population and economic growth and will require new levels of energy efficiency. In part two, we will examine hydrogen as a potential solution, define what Scope 1, 2, and 3 emission reductions really mean, and provide context for energy providers to consider as they work through this transition.

References:

- International Energy Outlook 2019 – EIA. www.eia.gov/outlooks/ieo/pdf/ieo2019.pdf.

- “Net Zero by 2050 – Analysis.” IEA, www.iea.org/reports/net-zero-by-2050.

- “World Population Prospects – Population Division.” United Nations, United Nations, population.un.org/wpp/.

- “OECD Economic Outlook: Statistics and Projections.” OECD Instance, www.oecd-ilibrary.org/economics/data/oecd-economic-outlook-statistics-and-projections_eo-data-en.

- “Battery Materials.” Rystad Energy – Energy Knowledge House, www.rystadenergy.com/energy-themes/supply-chain/battery-materials/.

- Becht Research and Analysis

Becht has a wide spectrum of experience in energy transition and decarbonization. For more information, please click below: