Understanding the Importance of Implementing a Marine Oil Cargo Loss Control System to Protect the Crude and Products You Trade

With Contributing Author Ed de Saegher

When buying crude, intermediate feedstock, blending components, or finished products for your refinery, you have multiple ways to transport and delivery them into your tanks. Additionally, you also have several options for the conditions under which those hydrocarbons are purchased (Incoterms). These terms provide many variations for when you take ownership, custody, or risk of the material but in all cases the main objective for your supply & trading group should be to receive the full volume you paid for. It seems to be a simple task that only requires few measurements, but it becomes a challenge when considering the multiple factors that potentially impact those measurements and making the volume difference higher than expected.

The difference between the volume you are invoiced (called Bill of Lading – B/L) and the volume you receive in your terminal or refinery (Outturn) is the Cargo Loss (In-Transit Loss, Ocean Loss or Marine Loss are also commonly used terms).

Why is it important to have a good system in place to ensure all cargo losses are within an acceptable tolerance? And what is an accepted tolerance level? When asking this question to many within supply & trading, a typical response might be 0.5 % is the tolerance that should be accepted because this is normally what the crude purchase contract establishes as a limit for making a claim to your supplier or shipping company. In most cases however, losses should be expected to be significantly lower than the 0.5% level. Worldwide statistics show that average crude cargo losses when transported by ship (on-shore loading port tanks to on-shore discharge port tanks) are between 0.15% to 0.20%.

Why is it important or why would you want to spend the time and resources to ensure that your average loss is more consistent with the lower threshold of 0.2% rather than 0.5% claim threshold? Is that small of a difference enough to justify the effort? Let’s do some quick math here to see what this 0.3% difference represents for an average refinery. Let’s assume the refinery receives and processes 150 thousand barrels of crude oil per day and the current price of crude is about $80 per barrel. So, with those assumptions the math follows:

150 KBD x 0.30% x 365 days = 164 KB/year @ $80 / Bbl –> 13.1 million $/year

Is 13 million dollars per year enough of a “prize” for your organization to set up a process to ensure your cargoes are under control and losses are minimized? It is certain that the 13 million number is definitely enough incentive for others to think about how to capture that volume if you don’t take care of it.

In this blog we will focus on crude cargo losses when using marine vessels for transportation. However, the concepts can be applied to all other products (intermediate or finished) as well as to other transportation modes like barges or even pipelines.

There are many reasons to implement a simple but effective crude cargo loss control system in your supply & trading organization:

- Financial: minimize the economic impact of losses in your profitability. As we showed in the example above, there are millions of dollars involved in crude transactions so even a small difference will have a significant impact financially. In short, you want to receive what you pay for.

- Control: protect your assets from potential misappropriation or theft. Just like the incentive is big for you, it is also big for others to think about how to manage tolerances in their favor and for their benefit.

- Claims: ensure you have a well-documented analysis to set a claim when required. If your company does not have a systematic approach for analyzing and investigating crude cargo losses, then it will be difficult to make and manage any claim when the contract tolerance is exceeded.

- Refinery HC Loss: help your refinery manage HC loss / mass balance. Crude oil is the biggest single custody transfer managed by a refinery. A good crude cargo loss system will provide the most important crosscheck a refinery needs for ensuring their HC loss system is under control.

- Business Relationship: clear and right measurements preserve long term business relationships and trust. Good measurement practices and process analysis will help to maintain your business relationship with your suppliers, customers, and transportation companies. Deliver what you invoice, receive what you pay for.

There are many factors that are involved in marine crude transportation that may potentially affect measurement. Let’s consider a quick guide for performing the analysis and reconciliation of a crude cargo. In-transit loss should be considered part of the hydrocarbon loss management culture that an oil company should develop and foster focusing on executing the practice with a shared vision of minimizing overall hydrocarbon loss.

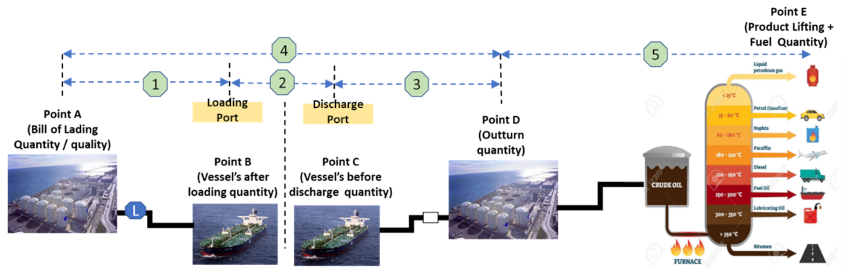

Let’s begin to understand the critical points for measurement when delivering a crude cargo to your refinery (or terminal). Conceptually there are for main points of control that should be considered in all marine crude cargoes for measurement:

Point #A: Onshore Tanks at Loading Port (Bill of Lading)

Point #B: Ship at Loading Port

Point #C: Ship at Discharge Port

Point #D: Onshore Tanks at Discharge Terminal (Outturn)

In the above figure the difference between Bill of Lading (Point A) and Outturn (Point D) is the total cargo loss. As it is shown, this total loss is normally split into three parts:

- Loading Port Loss: The difference between Bill of Lading and what the ship received on board.

- In-Transit Loss: The difference between ship volume measured after loading and ship volume measured when arriving at the discharge port.

- Discharge Port Loss: The difference between the volume the ship discharged, and the volume received at refinery/terminal tanks.

- Total Cargo Loss: The difference between the volume received and the volume loaded (Bill of Lading)

- Refinery HC Loss: It is the loss occurred inside the refinery and it is based on mass rather than volume.

Since all hydrocarbon materials (crude and products) have the characteristic that volume changes with temperature, then a reconciliation must be done on a common and standard basis. Normal standard temperature used in industry is 15ºC or 60ºF depending on the country or region. To adjust the observed volume to standard volume, a Volume Correction Factor (VCF) is used per API petroleum measurement tables. Those tables require two data points to determine the appropriate VCF, temperature and density. We still have some other adjustments to make. Water and sediments are not material you want to pay for. So, we need to measure them in order to get the Net Standard Volume of the crude oil (the part we pay for). This requires not only an additional measurement (free water) but also the need to sample the crude and test it for suspended water and sediment (BS&W). Basically, we can say the required measurement for a crude cargo loss analysis and reconciliation should include volume (tank level or meter), temperature, free water, density, and BS&W.

In a simple way we can summarize the following:

- Tank Level + Tank Calibration Table –> Observed Volume

- Temperature + Density –> VCF (using API Tables)

- Observed Volume + VCF –> Gross Standard Volume (at reference temperature)

- Gross Standard Volume – Free Water – BS&W –> Net Standard Volume (NSV)

NSV calculated at each of the points mentioned in Figure 1 above should be compared to calculate losses in the total as well as each part of the crude transportation circuit.

It sounds very simple, and it is in concept, but several other factors may impact the accuracy at the time of measurement thus impacting the final reconciliation and loss calculation. A few of these factors are briefly addressed below.

Immediately after a crude cargo is fully discharged in your terminal, the surveyor together with the onshore representative should be responsible for checking that the volume is inside contractual tolerance so the vessel can disembark and not be subject for demurrage fees. After the surveyor issues the final cargo report with all information for the loading port, ship, and discharging operation, the supply and trading analyst should start a process to analyze and investigate.

This analysis could be very simple and straight forward when the cargo does not have any issue and volume losses are as expected (let’s say below 0,2%). It may be more complex and may require a full investigation in cases where the loss is well above the contract tolerance so all documents should be reviewed to find the causes for those losses and proceed with a claim, if applicable.

It is essential for the investigation process to include all operations information and documentation provided by the surveyor to find the issues that may have resulted in the losses. People tend to think about physical losses but in many cases, we are talking about apparent losses driven by measurement errors or issues, sampling reporting issues, or simple calculation errors.

Physical losses, like evaporation, are now reduced due to the use of inert gas in ship tanks. However, for those crudes with high RVP loaded in warm temperatures (in some cases with temperatures above 40 C) it may be an important consideration at loading port for proper measurement calculations. Other important considerations in the proper accounting and measurement of crude oil transfers are remaining on board (ROB) and quantity on board (QOB) measurements. The surveyor plays a key role in considering and capturing these measurements to protect the integrity of the cargo.

When talking about apparent losses, the use of different VCF tables can have a significant effect on cargo reconciliation with financial impact. The use of an in-line automatic grab samplers is crucial to ensure the water and sediment content are properly quantified and deducted as well as obtain a representative density for the full cargo. Many other factors should also be considered when doing the analysis specially when the cargo involve ship-to-ship (STS) operations (lightering or top-off), comingled cargoes or long submarine pipelines that may need to consider the impact of line packing or displacement operations.

As you consider your crude cargo loss control management practice, where are you on the continuum of practice balance and benefits? Do you have trained and experienced people looking at your crude cargo transactions to identify any potential bias in measurement that is impacting the losses? Were all people involved in the process well trained and able to identify issues and develop a successful claim by ensuring the right documentation and analysis is in place.

Protecting your assets includes the crude you are buying and receiving into your refinery/terminal. Remember, despite the size of your refinery, the money involved in these transactions is always enough to justify efforts in ensuring a flawless process for loss control.

Becht has international experience in helping develop the technical, tactical as well as the organizational aspects of developing a marine cargo loss control system and train your people to ensure they execute an effective analysis and investigation to protect your assets. If you would like to discuss further, please contact us.