Evaluating Purchased Feedstocks for Hydrocrackers and Hydrotreaters

I had multiple requests to discuss how to evaluate purchased feedstocks for hydroprocessing units. As always, I’ll present some ideas and welcome further comments and thoughts.

Jack be nimble, Jack be quick!

In my background, the question of whether to purchase a feedstock for a hydroprocessing unit comes up with very little notice and sometimes with substantial pressure to just say yes! There is no better answer to be nimble and quick than preparation and planning. I have seen great value in key members of the refinery working together proactively to identify and agree what range of feed parameters can be acceptable in all situations, what range of feed parameters will never be acceptable, and the process to assess the risks/trade-offs to handle any feed that doesn’t fall into either of the two previous categories.

Another critical consideration is the type of purchase being considered. Is this a “one-off” opportunity purchase or a long terms contract? The team should insist on taking the time for a rigorous and thorough assessment (including a feed variability assessment) when a significant amount of “grey zone” feed is being considered for a long term “take or pay” agreement. A less rigorous assessment can be appropriate for a “one-time” modest parcel of feed that can be segregated in tankage and run off slowly if necessary.

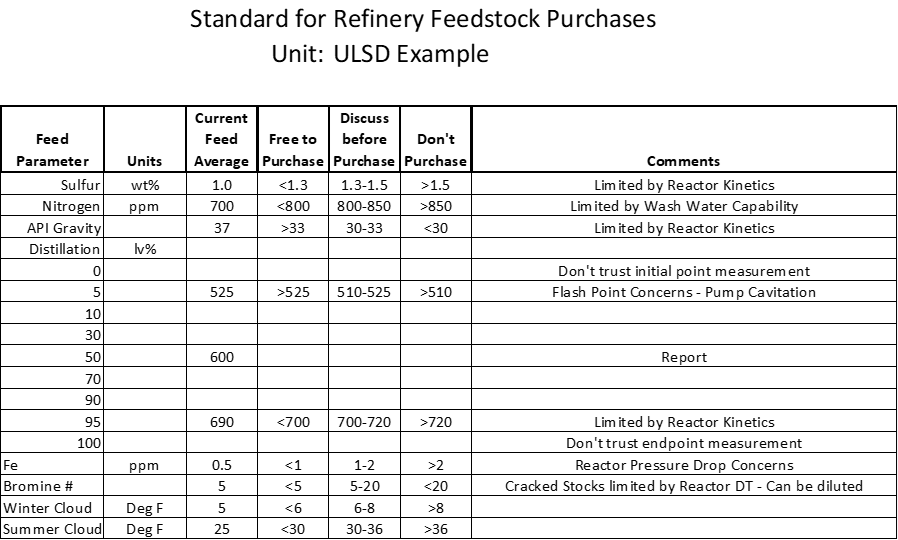

A partial example of a feedstock agreement or standard is shown below. The limits in a purchased feedstock standard should be established through a team that includes representation from planning, operations, and process engineering. Setting limits requires experience and calculations.

Most refiners have LP models that simulate processing costs and calculate potential profits for purchased feedstocks. These models can identify if there is enough hydrogen and processing capability for a purchased stock and generally provide a good first pass on what a purchased stock may be worth. However, in my experience most of these models do not calculate catalyst life impacts very well nor do they consider that some challenging feeds can be diluted to minimize the difficulty in processing a stock. LP models cannot calculate the impact of contaminated stocks on reactor pressure drop. Therefore, there is still a need to discuss a potentially challenging opportunity feed purchase and get detailed estimates of the processing costs and impact on the unit and the refinery.

It’s all about the economics (most of the time)

There are a few exceptions, but most decisions on purchased feedstocks should obviously focus on economics. Would you run a stock that made $1MM for the refinery if it cost $0.25MM to process it? Of course, you would! While each refinery will have its own risk tolerance and economic criteria, a typical rule of thumb used is to have a 3:1 payout when running purchased stocks.

Would you run a stock that made $1MM that cost $1MM to process? This stock purchase would be highly discouraged because there are risks associated with purchased stocks:

- Feed properties are different than advertised

- Feed contains contaminants that were not identified in the analysis

- Feed is contaminated during shipping

- Feed is much more difficult to process than expected

A stock can be much more difficult to process than expected when the feed has been previously hydroprocessed, such as in a synthetic crude. Previous processing typically removes all the easy sulfur and nitrogen, leaving only the harder to remove molecules behind. The feed looks easy but can be very difficult to process.

There are rare feeds that nobody should purchase. As an example, a few years ago, some Russian crude was offered on the market at an extreme discount. The discount came because the crude had been contaminated with chlorides. If I recall correctly, the chlorides in the crude had been measured in the range of 50-100 ppm or more!

Every oil trader in the world salivated at the discount and pushed their technical people to consider this crude. Most companies quickly and prudently declined this purchase. I heard stories that a few refineries in Europe ran this crude and a couple of these refineries ended up shutting down due to corrosion and leaks that occurred. This is an extreme example, but one that shows sometimes it’s just not worth any amount of money to run a terribly contaminated feed.

Processing costs

Assuming you can easily transfer the stock to your refinery and to the unit, then there is a need to estimate the impact on unit for catalyst fouling, hydrogen consumption, reactor pressure drop, exchanger fouling, etc. Many refiners have kinetic models that can estimate catalyst fouling and hydrogen consumption. Experience and comparison with current feedstocks should be used to estimate the impacts on items such as reactor pressure drop and exchanger fouling.

Catalyst Fouling

Catalyst fouling is caused by coke or metals neutralizing active sites on a catalyst – mostly by covering the active sites and making them inactive for reactions to take place. For hydroprocessing reactions to take place, the hydrogen and the oil molecule need to touch or otherwise interact with the active sites for the reactions to occur.

Total fouling consists of coke fouling plus metals fouling.

Coke Fouling

Coke fouling increases with:

- Higher boiling point (especially increased 95% boiling point)

- Lower API gravity

- Higher amounts of olefins and aromatics from cracked stocks

- Higher levels of asphaltenes (VGO and heavier feeds)

- Higher reactor temperatures, which can result from feeds with higher sulfur and nitrogen, or other factors that cause reactor temperatures to be raised during processing.

- Lower hydrogen partial pressures which can occur when a feed consumes significantly more hydrogen during its processing

A qualitative measure of coke fouling can be done by comparing the average feed to a unit with the potential purchased feedstock. Kinetic models should be used for a quantitative comparison.

Metals Fouling

Metals fouling increases with

- Metal concentration

- Metal type – some metals foul catalyst more than others

The effect of some common metals is shown in the table below. Your catalyst vendor may be able to provide some additional data on metals fouling. This data can be used to estimate the fouling that will occur from a cargo of purchased stock.

|

Metal |

Possible Sources |

Fouling Effect |

| Nickel | Carryover from resid to VGO in crude unit |

5 |

| Vanadium | Carryover from resid to VGO in crude unit |

5 |

| Iron | Corrosion – found in some crudes |

5 |

| Silicon | Antifoam usage in upstream or coker |

5 |

| Sodium | Poor desalter operation, caustic carryover |

10 |

| Arsenic | Crude |

40-50 |

Reactor Pressure Drop and Heat Exchanger Fouling Concerns

Characteristics of purchased feeds that can affect pressure drop and exchanger fouling include:

- Olefin and di-olefin content

- Particulate content

- Chlorides (and halides)

Olefins

Olefins and especially di-olefins react in the presence of oxygen to form polymers. A bromine number higher than 2 means that olefins are present. These polymers can drop out of solution as the feed is heated up and foul heat exchangers and potentially cause reactor pressure drop. The best way to prevent polymerization is to prevent the stock from contacting oxygen, although this can be next to impossible during transport and storage. The next best method to prevent polymerization is to use an oxygen scavenger additive to the stock during transport and storage. It may also be necessary to add a solvency additive to the feed before processing. A refiner can avoid purchases of cracked stocks to avoid olefins, but this strategy will likely eliminate the purchased stocks that would make the most money.

It’s difficult to predict exactly how much pressure drop or exchanger fouling can result from olefins, so it may be necessary to try some feeds and monitor fouling very closely to learn how it affects your unit.

Particulates

The effect of particulates is obvious – they plug up the interstitial space in between the catalyst pellets and sometimes can plug catalyst pores. Particulates are best handled with a combination of feed filters and catalyst grading. A new unit is typically designed for a particulate content of 1 ppm. For higher particulate concentrations, units are typically equipped with a feed filter.

Discussion of particulates and pressure drop prevention is a topic that deserves its own discussion, so I’ll discuss this in a future blog. In general, units with feed filters and catalyst grading can deal with higher levels of particulates, but particulate levels upwards of 10 ppm or more can be very difficult to handle. As with olefins, it may be necessary to try some feeds with particulates and closely monitor exchanger fouling and pressure drop.

Chlorides

Chlorides in a feed will form ammonium chloride salts that can foul the reactor effluent exchangers. Some analyses only focus on inorganic chlorides, but it’s important to know the total chloride content as organic chlorides will be converted to inorganic chlorides in a hydroprocessing reactor. Higher levels of chlorides in the feeds will cause salt formation earlier in the reactor effluent exchanger train – the sublimation temperature of the salts will be higher, and salts will deposit at hotter temperatures. Other halides such as fluoride can also form salts if present as a contaminant in the feed.

Chlorides can contaminate a feed during shipping due to sea water contamination, so it’s important to analyze all purchased feeds for chlorides to understand the impact on your unit.

Dilution

High levels of olefins, particulates, or chlorides can be dealt with by dilution. All these contaminants are less troublesome to a unit at lower concentrations, so consider putting a purchased feed in a tank and diluting it with other feed that dilutes the problem. Dilution can be a valuable resource if your refinery has the facilities to allow it.

Catalyst Economics

Here is my preferred way to calculate and view catalyst economics:

Assumptions:

- Catalyst load cost = $5MM

- Downtime for an ULSD unit costs = $3/barrel on a 40,000 BPD unit.

- Maintenance and contractor cost for changing catalyst is $4MM

- Time to change catalyst = 14 days (stream-to-stream)

Calculations:

Downtime cost to change catalyst = 3 $/bbl * 40,000 BBL/Day * 14 Days = $1.7MM

Total cost to change catalyst = Cat cost + Downtime cost + Maintenance cost = $5MM + $1.7MM + $4MM = $10.7MM

If the catalyst life is 2 years, then the total catalyst cost per year = $10.7MM / 2 = $5.4MM/year

Let’s say a difficult purchased feed lowered the total catalyst life from 2 years to 1.8 years.

For a 1.8-year catalyst life, the total catalyst cost would be $10.7MM/1.8 years = $5.9MM/year

Therefore, the catalyst cost penalty for the difficult feed would be $5.9MM – $5.4MM = $0.5MM

Remember to add the cost of any extra required H2 and energy to run the difficult feed.

For a 3:1 payout, we would need to make over $1.5MM on the difficult feed to payout the $0.5MM cost in loss of catalyst life!

If you were calculating similar costs for a hydrocracker, then you would need to account for any changes in product yields in addition to the extra catalyst life costs.

Application in your unit(s)

- Have you established a Refinery Standard on purchased feeds to enable faster decision making and keep the refinery team working together on purchased stocks?

- Do you have access to a model that can predict catalyst fouling effects for purchased feedstocks?

- Are you prepared to quickly evaluate a purchased stock and approve or deny it for your unit? Do you need to build tools to make this task easier and quicker?

- Do you have a method and facilities to dilute purchased feeds if necessary to enable processing?

Do you need assistance evaluating your purchased feedstocks hydrocrackers or hydrotreaters? Feel free to drop us a line.