Under Pressure II

CLICK HERE to view Part 1 of this series

Tenets of Catalyst Selection

I have had several suggestions to write about catalyst selection. This is a popular topic in many journals and blogs with some authors taking controversial stands on several issues. I thought I would approach the subject by describing the important tenets that should be part of all catalyst selection processes for hydrocrackers and hydrotreaters.

Just a word about my approach and background. Many authors approach this topic from a sales perspective, but I have no interest in selling you anything. My view comes from 35 years of experience in selecting, buying, and then being held accountable for my recommendations and choices. My career progression, salary, and bonuses depended on consistently making the right choices. To some degree, the profitability of the refineries I supported depended on consistently making the right choices.

I hope that you can help your refinery’s profitability by following these catalyst selection tenets that apply both to hydrocracking as well as hydrotreating. When I refer to catalysts in this blog, I refer to both singular catalysts as well as catalyst systems. Let me know what you might add to this list!

Tenet #1 – “In God we trust, all others bring data” -W. Edwards Demming

I encourage you to read and understand Dr. Demming’s data science work, but the main lesson he gives is that all decisions should be based on good data. Many catalyst vendors will provide estimates and projections, but these “paper” estimates are sometimes not based on good data or can be based on a wild extrapolation of data.

Here is the data you should seek in order of benefit:

- Commercial data from a service like yours

- Hopefully, a vendor can provide commercial data in a service that has a reasonably similar LHSV, H2 partial pressure, and feed.

- A back-to-back comparison of two catalyst’s commercial operation can be helpful, even if the operating conditions and feed are not exactly like yours.

- Good commercial data should include both initial activity data and fouling data. I have observed that some catalysts may not have good initial activity, but more than make up for the poor activity with superior fouling resistance.

- Pilot plant data

- It is difficult to compare pilot plant data to commercial data. The best way to look at pilot plant data is comparing it to other pilot plant data. One set of pilot plant data by itself with no comparison doesn’t have much value.

- For example, if 2 sets of pilot plant data at similar conditions with the same feed show that the new catalyst has an activity advantage over the old catalyst, then you might reasonably expect a similar “delta” in commercial operation if the operating conditions are like your service.

- Most pilot plant data will only show initial catalyst activity, but I have observed that accelerated fouling data from two pilot plant runs at the same conditions with the same feed can show a good comparison that can roughly be applied to commercial operation. (Note that many vendors will disagree with this statement simply because they don’t want to run accelerated fouling tests 😊).

Activity and Fouling Data

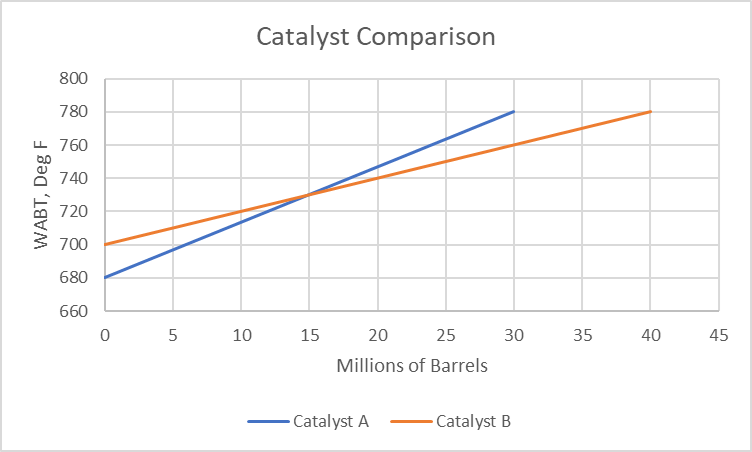

- There are catalysts out there that may not show great initial activity but show far superior fouling resistance as the example shown in the graph below. Catalyst B has a higher start-of-run temperature, but better fouling resistance than Catalyst A. Overall, Catalyst B gives a much better performance over the entire run. Therefore, both activity and fouling data have value.

Tenet #2 – New catalysts should provide a good payout compared to the previous catalyst

New catalyst with higher cost should provide at least a 3:1 payout compared to a previous catalyst.

- Purchasing a new, more-expensive catalyst comes with risks:

- The catalyst will not perform as advertised.

- A refinery upset will coke up the new catalyst before you can realize the benefits.

- The reactor will develop a high pressure drop and you will need to dump the catalyst prematurely.

This 3:1 rule-of-thumb is especially true for some of the new step-change catalysts that come at very high costs. Refineries don’t build new units unless the payout is at least 3:1 – why would anyone buy a more expensive catalyst without being sure of a good payout?

Of course, some hydroprocessing services are mild and don’t require high activity catalysts. In this case it may be acceptable to simply choose the cheapest catalyst with reasonable performance.

Tenet #3 – Hydrocracking catalyst choice is all about product YIELDS (and maybe cheaper feedstock)

- 90% of the effort in selecting catalyst for a hydrocracker should be focused on product yields

- Increased liquid yield volume and volume expansion

- Increased yields of the highest value product(s)

- Flexibility to change product slates when economics dictate

- Improved product quality (higher diesel cetane, jet smoke, etc.)

- See Tenet #2 for payout requirements on yield improvements

5% of the effort in selecting catalyst for a hydrocracker can be focused on increasing the ability of a unit to feed cheaper feedstocks or allowing cheaper crude to the refinery. The remaining 5% of the effort can focus on everything else: catalyst cost, catalyst quality, delivery, etc.

Get the product yield improvements right and you’ll be a superstar. Get it wrong and they will probably downgrade you to working on the FCC unit.

Hydrocracking data is most valuable when it includes data with the pretreat (hydrotreating) catalyst and the hydrocracking catalyst running together. There are many synergies between the pretreat catalyst and the hydrocracking catalyst and they should always be tested and chosen together to get accurate yield data.

Tenet #4 – Choose grading and support catalysts independently from the active catalyst

Most people don’t buy tires from the same place they buy the car because they want to choose the best from both vendors. Why would you buy grading and support catalysts from the vendor of the active catalysts unless you were convinced, they had the best stuff? In other words, there are good reasons to choose grading and support catalysts independent of the active catalyst, although some active catalyst vendors also have good grading catalyst.

Even if your active catalyst vendor has access to a variety of grading and support catalysts, they may charge a markup price for selling it with the active catalysts. Don’t be afraid to shop around but remember Tenet #1 – base decisions on data.

There are novel support catalysts available in the market that help to minimize the number of layers of support required at the bottom of reactor beds. I recommend you seek out these novel support catalysts to minimize the volume and height of support catalyst needed allowing you to maximize the amount of active catalyst loaded.

Tenet #5 – Carefully consider costs/benefits when choosing a sulfiding method

A lot of refiners are using pre-sulfided catalysts for good reasons. Using pre-sulfided catalysts can save time during startup if the pre-sulfiding is done properly and the startup procedures are executed correctly. Pre-sulfiding does depend on a vendor completing the pre-sulfiding correctly and it does require additional lead-time for a purchase with more complicated logistics. Pre-sulfided catalysts should always be stored and loaded in an inert environment for personnel safety.

On the other hand, in-situ sulfiding is an excellent strategy. If the right resources are available and procedures are executed well, in-situ sulfiding can be as fast as using pre-sulfided catalysts. In-situ sulfiding is a process that has proven to provide successful results for decades and many refiners have developed best practices to make sure this process yields good results with a minimum time requirement. I recommend In-situ sulfiding for layered catalyst systems such as are used in hydrocrackers and many hydrotreaters.

These days, I have developed a fear that pre-sulfided catalysts are now being used as a default by some refiners without fully understanding the costs and benefits. This creates a situation where presulfiding vendors can raise their costs knowing that refiners are comfortably “hooked.”

Always look at the total costs and benefits to properly compare in-situ sulfiding and pre-sulfiding to make sure you are minimizing costs and maximizing the catalyst performance. Never allow your refinery or company to become dependent only on pre-sulfided catalysts.

Tenet #6 – Have a proper quality control process for catalyst

Catalyst suppliers are currently stretched thin on production capacity as refiners around the world have constructed new hydroprocessing units, especially a few, very large resid processing units. With catalyst supply tight, refiners should have a good catalyst quality control process in place. A load of catalyst with inferior quality can shut down a unit very quickly with a substantial lost profit, so it goes without saying that refiners should only work with suppliers that can meet their quality requirements.

Refiners must order catalyst with plenty of lead time to allow for excellent quality control and substitution of catalysts when necessary. If pre-sulfiding is used, then the lead time increases further with requirements for extra transportation and multiple shipments.

Refiners should expect to receive Certificates of Analysis (COA) prior to catalyst being shipped from the supplier. The COA should include the following results listed with minimum requirements:

Physical Properties:

- Crush Strength: > 3 mm/inch

- Fines level: < 2 wt% of catalyst

- Attrition: < 2 wt% of catalyst

- Alternate – Total fines + attrition: < 4 wt% of catalyst

- Dust level during loading must be low

- No contamination (foreign objects, catalyst clumps, etc.)

The COA should also include catalyst qualities important for performance. These properties are dependent on the catalyst type and requirements.

Important properties include:

- Metals content

- Surface area

- Pore volume

- Density

- Expected density for dense loading and sock loading

If catalysts are pre-sulfided, then refiners should expect to receive a COA from the sulfiding vendor that includes important properties of the catalyst including sulfur uptake. Again, the COA should be received prior to the catalyst being shipped.

If a catalyst is not pre-sulfided, then a portion of the catalyst should be examined when it arrives at the refinery to assure proper quality. Unfortunately, pre-sulfided catalyst must be kept inert, so a visual examination may not be possible until the catalyst is being loaded.

Tenet #7 – Don’t use the same catalyst more than twice without a robust selection process to make sure you are using the best catalyst for the service

Everyone is busy, but catalyst selection can make or break a large amount of money. Don’t go too long without looking around to see if there are better catalysts, both with your current supplier and with other potential suppliers. Competition between catalyst vendors is very fierce, so take advantage of the competition by always knowing what’s available on the market.

It’s a good idea to keep good relationships with a wide array of catalyst vendors so you know when new catalysts are being offered and available.

My rule-of-thumb is to never load catalyst more than twice without considering new catalysts and new vendors, but the actual time depends on the service and how important catalyst performance is to the profitability of your unit and refinery.

—————–

That completes my list of the 7 most important Tenets for Catalyst Selection. What would you change or add to the list based on your experience?